An EMV storm is brewing in the US and has got many hospitality operators battening down the hatches. In short, EuroPay, MasterCard and Visa have clubbed together to set the standards for chip card payment. These new cards contain a chip that holds the account number and other sensitive data as well as logic for transaction processing and risk management. So what’s the big deal? EMV is causing chaos as operators scramble to either upgrade or enhance their current POS systems to accept EMV payments. And that doesn’t come cheap. It also means customers need to get used to a new way of paying for things which could make closing a check a longer, more arduous process than it already is.

The bad news is ignoring EMV is not an option. If ignored, you’ll be liable for any data breaches and chargebacks to the business and the financial repercussions are definitely not worth the risk. The good news is there is an alternative to EMV reliance, it’s cheap and your guests are already very familiar with it: mobile payment.

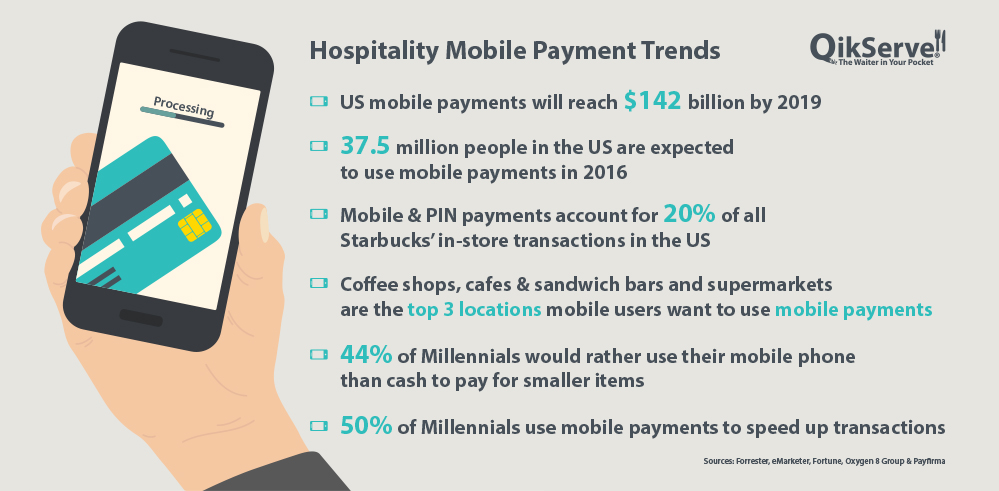

Mobile is one of the fastest growing trends in payments. You just need to look at eBay and Starbucks to get an idea of the significant impact mobile is making on businesses today. 25% of customers who buy items on eBay use their phone and mobile accounts for 20% of all in-store transactions for Starbucks. In the US, 37.5 million people are expected to use mobile payments this year with 37% of 25-34 year olds adopting the technology by next year.

These numbers show US consumers are already familiar with using their smartphones to pay for things, regularly using their mobile devices to browse and shop for products as well as self order and pay for food and drinks. Continuing to encourage mobile payments throughout your hotels, casinos, restaurants and other types of hospitality venues, means reducing guests’ reliance on EMV and, importantly, a need for fewer EMV compliant terminals bringing costs down dramatically.

Mobile really has the potential to be that gift that keeps on giving. It not only softens the EMV investment blow but can actually make you money through integrated incentives like promotions and loyalty programs that attract new users and keep existing users coming back. Dunkin’ Donuts goes all out with its offers making it the main focus of its application along with gifting, pre-order and payment. The app has been downloaded more than 15 million times since its launch in 2012 firmly demonstrating its popularity.

Mobile really has the potential to be that gift that keeps on giving. It not only softens the EMV investment blow but can actually make you money through integrated incentives like promotions and loyalty programs that attract new users and keep existing users coming back. Dunkin’ Donuts goes all out with its offers making it the main focus of its application along with gifting, pre-order and payment. The app has been downloaded more than 15 million times since its launch in 2012 firmly demonstrating its popularity.

By grabbing the mobile payment lifeline, EMV goes from being a category 5 hurricane headache to more of a mild, drizzly annoyance. You may not be able to get away from being non-compliant purely from a security liabilities perspective but you can get smart with smartphones by bringing the familiarity of mobile payment into your stores and scoring additional revenues with some creative, data-led mobile marketing in the process.