5 ways poor integration is crippling your restaurant’s mobile potential

Is your guest-facing technology plagued by silos of information, disparate databases and a spaghetti junction of separate systems that don’t talk to each other? Are you failing to get the most from your data and CRM systems and overwhelmed by where to start to fix this situation?

You’re not alone. Many restaurants, casinos, hotels and stadiums are failing to clamp down on the chaos and are reluctant to make the move to a cloud-based, fully integrated mobile solution. By facing the challenge head-on, a mecca of modernised customer journeys, flexible order and pay, revenue-boosting smart marketing, leading-edge loyalty, effortless social sharing and more awaits the brave and forward-thinking operator!

Here are 5 ways poor mobile integration is affecting your restaurants’ operations and profitability:

1. Checks can’t be updated by both staff and customers.

Picture the customer journey: your guest, James, pre-orders a steak and ale pie and a bottle of Corona from his mobile so when he arrives at your busy restaurant that’s gearing up for lunch hour, all he has to do is settle in at his table before his meal is served a few moments later. Half way through his pie, James fancies another Corona and decides he’d also like to fill up on an apple and pear crumble. He flags down a waiter and attempts to add this to his check. Unfortunately, his mobile order isn’t synched to the restaurant’s point-of-sale (POS) so unless he wants to start another check, he’ll have to order through his mobile. James isn’t happy he doesn’t have the choice between ordering with a waiter or his phone and wonders why the restaurant hasn’t synched up their digital and in-house services.

If your restaurant order app isn’t integrated with your POS, you’re essentially restricting your customers’ option to one channel, either waiter or mobile. It’s a fragmented and stilted customer journey that guests won’t appreciate and could turn them off using your app in the future.

2. No reconciliation with existing merchant accounts.

When it comes to in-app payments of food and drink, if your mobile solution isn’t talking to existing merchant accounts or payment providers then there will be double the amount of reconciliation work to be done at the end of each day. This means your operational efficiency will take a big hit and you’ll be less than popular with management responsible for the extra cashing-up work.

By integrating your mobile payment with merchant accounts currently being used by your existing POS, all payments, be it mobile or via wait staff, will be reconciled together meaning less work for your back-of-house staff.

Free eBook: Top 10 strategies for ultimate loyalty that pays – Download it here today

3. Lack of personalised

One of the most valuable aspects of mobile order is its ability to capture very detailed information about your customers’ preferences and past buying behaviors. However, if this gold mine of information is captured but not cross referenced or added in any way to your existing CRM system and marketing and loyalty platform then you may as well not have captured it at all.

The value of customer data is only realised if you’re smart with it, attributing behaviours and preferences to a specific person and using it to provide very tailored and personalised marketing offers. In fact, Accenture found that 73% of consumers surveyed said they prefer to do business with retailers who use personal information to make their shopping experience more relevant.

Imagine you’re walking down the street and you receive an alert on your mobile saying: “Happy Birthday Will! You’re pretty close to our store, why not pop in for your favourite: a birthday brownie? Our gift to you on your special day!” All that data: Will’s location, his birthday and his favourite food, are all pieces of information captured from registering for the app as well as past behaviour which can be stored in Will’s profile in the operator’s CRM system. It’s only when the CRM system, marketing platform and mobile app work together in a unified way, that this type of sophisticated and powerful made-to-measure marketing can be achieved.

4. Generic loyalty.

Related to a one-size-fits all marketing approach is generic loyalty, meaning there is no special treatment of high value customers as you have no view into who they are or their preferences. Take two tables for example, the first is a family table of 2 adults and 2 young children, the second is a businessman. Which is the more valuable table? You might think the family of four as there are four times the mouths to feed but when you look at the data, the chances are the businessman is ordering higher priced items such as wine or beer and a steak rather than kid’s meals and fast finger food.

By knowing that the businessman is a higher value customer, you are able to treat him differently from other lower value patrons. However, that family of 4 might order cheaper meals but over time, they visit your venue a lot more frequently than the businessman. In which case it is that family you need to focus your loyalty efforts on.

Knowing the value of customers’ purchases over time is the key to successful loyalty as it’ll allow you to focus on your most profitable customers, gradually growing their lifetime value as you entice them back time and again with a fully tailored VIP experience that exceeds their expectations.

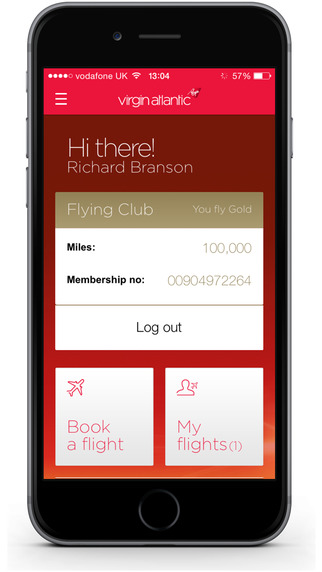

Virgin Atlantic Flying Club has a tiered loyalty program offering benefits in the early stages to hook the customer into coming back. As passengers fly with Virgin more, they progress from Red to Silver and then Gold club members, their benefits steadily get better:

Virgin Atlantic Flying Club has a tiered loyalty program offering benefits in the early stages to hook the customer into coming back. As passengers fly with Virgin more, they progress from Red to Silver and then Gold club members, their benefits steadily get better:

- Red Club: earn miles on flights, get discounts on rental cars, airport parking, hotels and holiday flights.

- Silver Club: earn 50% more points on flights, access expedited check-in and priority stand-by seating.

- Gold Club: double miles, priority boarding, access to exclusive clubhouses where they can get ab drink or a massage before their flight.

5. Increase in ‘dine and dash’ cases.

Global incidences of customers walking out without paying are on the increase especially as the world economy starts to recover. During the height of the recession, reports of dine and dash cases increased by 30% as unscrupulous diners looked to save their pennies.

According to Aaron Allen Associates, the best prevention is exceptional service as jilting the bill tends to happen when guests aren’t being attended to properly. What better argument for mobile self-service when a would-be ‘dasher’ is able to pay when he or she wants through their mobile, curbing the need for shady behavior?

If your mobile app and POS isn’t integrated, it makes it easier for that very small proportion of unsavory customers who dine and dash. Having a non-integrated system means staff won’t be able to see on the POS if table is paid or not. However, if the two systems are in synch, and staff see a whole table walk out, it only takes a quick glance at your POS terminal to see that the check has been paid and the table is closed ready for resetting. Oracle POS systems for example, have the ability to split the POS screens for wait-staff so they can see which transactions are via their web or mobile channels and which are table orders allowing staff to better manage their sections and be more in touch with their guests.

When considering the role of mobile in reducing walkout incidences, it’s worth noting the ability to pre-authorise cards when guests order via mobile. By going digital, the customer’s order is tied to a pre-authorised card, making eating without paying difficult.

The Silver Lining: Cloud-enabled, integrated innovation

The chaotic mismatching of POS, CRM, mobile and loyalty platforms for operators has come about for several reasons. No single Hospitality tech provider offers the complete range of systems that are fully integrated and compatible with each other. In the past, the cost of getting all these systems to speak to each other has been prohibitive and the complexities daunting for the more risk averse operators.

Now, restaurants are starting to recognise the need to create an integrated system in order to reach their full mobile potential. The solution?

The Cloud.

By making the move to a cloud-based POS environment, restaurants and other hospitality operators can centralise intelligence pulling in information from what once were separate databases to inform activities such as marketing and even operations. As well as this powerful integrated environment, operators will also be able to turn features of their app on and off as required, scale up or down according to their businesses’ needs, bring consistency across their estate and enjoy faster deployment of new functionality.

So secure that competitive edge and integrate to innovate using the power of the cloud to make it all possible. Not least, it might even save some of your more impatient customers from a life of crime!