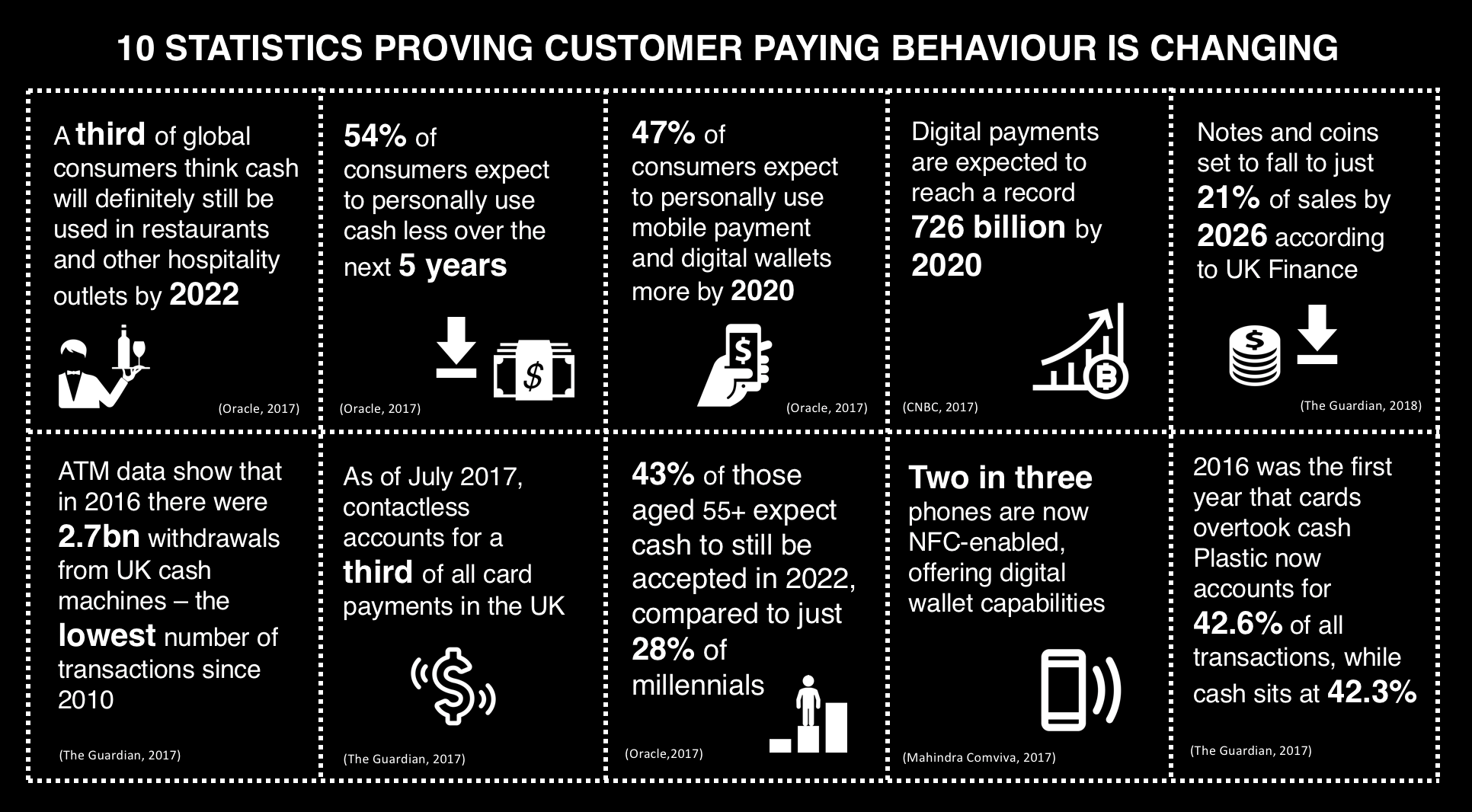

Oracle recently published a survey looking into the use of cash in the Hospitality industry. The leading point of sale provider asked 15,000 consumers around the world about their use of cash and other payment methods in restaurants and food service outlets.

In the report they argue whether cash is dead; the consensus being that, yes, cash is on the decline, and digital transactions are booming, but there is still a need for cash with a third of consumers still expecting to pay with cash in 2022, albeit a lot less frequently[1].

From contactless to wearable technology – customer expectations are changing when it comes to payment with more and more people preferring the speed and convenience of digital transactions over cash or check.

These stats have not gone unnoticed by big name Hospitality brands such as Shake Shack, Amazon, Sweetgreen, Panera and Starbucks – who have all opted to ditch cash from some or all of their stores in response. And for good reason.

1. A reduction in cash handling

Limiting cash transactions reduces time spent cash handling and journeys to and from the bank. Furthermore, by automating the reconciliation process operators can reduce the risk of human error and improve speed and efficiency.

2. A safer, cleaner environment

Having large amounts of physical money on-site puts both customers and staff at risk. Cash has also been handled by thousands of people and having it in such close proximity to food is an often overlooked health risk.

3. Integration into guest-facing self-service technology

Compared to cash, digital payments offer easier integration into guest-facing self-service technology such as kiosks, mobile apps, web and table tablets. Although sometimes costly to implement, these technologies tend to have an ROI of twelve months or less and are proven to increase average ticket value by 20% through the pushing of higher value and combination items to the customer ie. ‘Add cheese?’ (cross sell), or ‘Go large?’ (upsell).

Panera Bread has found great success with its guest-facing self-service strategy. Customers who order and pay for food and drink via the chain’s kiosk, mobile and web apps are visiting the store 45% more after just twelve months. And for those that only like to pay at the kiosk, it’s a 12% increase over the same period. 70% of Panera’s payments are now made digitally, with 75% coming from Apple Pay.

4. Enhanced customer journey

Cash is anonymous and untraceable, providing no opportunities to personalise the customer journey. Digital payment lends itself to self-service technology that can offer bespoke customer experiences informed by past buying behaviour, brought to life with intuitive UI/UX designs that make ordering and paying for food quick, simple and enjoyable. Without the hassle of waiting in line. Customers can earn loyalty points and redeem vouchers without having to remember a card, and have the flexibility of spending their points across a variety of touchpoints both on and off premise.

5. Access to big data

Digital payments, particularly those made through mobile, provide Hospitality operators with a wealth of data that can be used to monitor customer buying behaviour, spot trends, inform product development, improve marketing activities, personalise loyalty schemes and much more. The list is endless when it comes to big data. Knowledge is power; and the more you know about your customer the more you can cater to their needs.

[1] 54% of consumers expect to personally use cash less in the next five years (Oracle, 2017)